In a groundbreaking development that has captivated the luxury watch industry, the Rolex Bucherer Acquisition was officially announced on August 24, 2023. This monumental deal not only fortifies Rolex’s standing as a market leader but also redefines the dynamics of brand-retailer relationships in the high-stakes world of luxury watches. In this in-depth article, we’ll explore the various facets of this acquisition, its strategic implications, and its potential impact on the future of the luxury watch market. See Rolex’s official announcement here: Rolex Official Announcement.

Setting The Stage Tor The Rolex Bucherer Acquisition

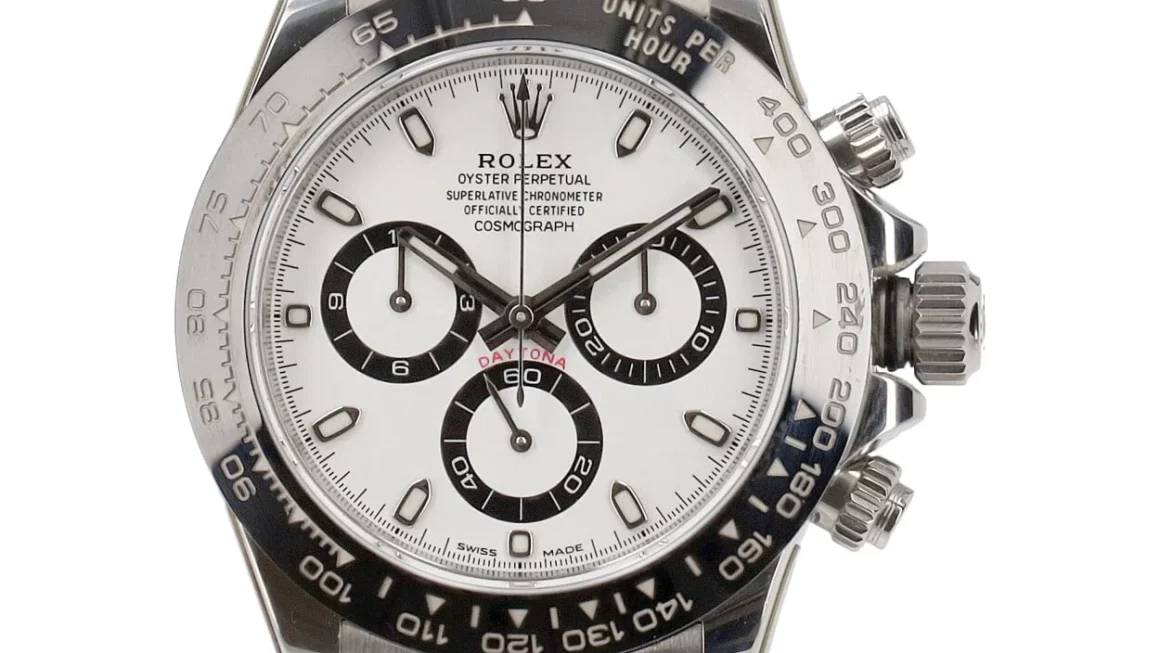

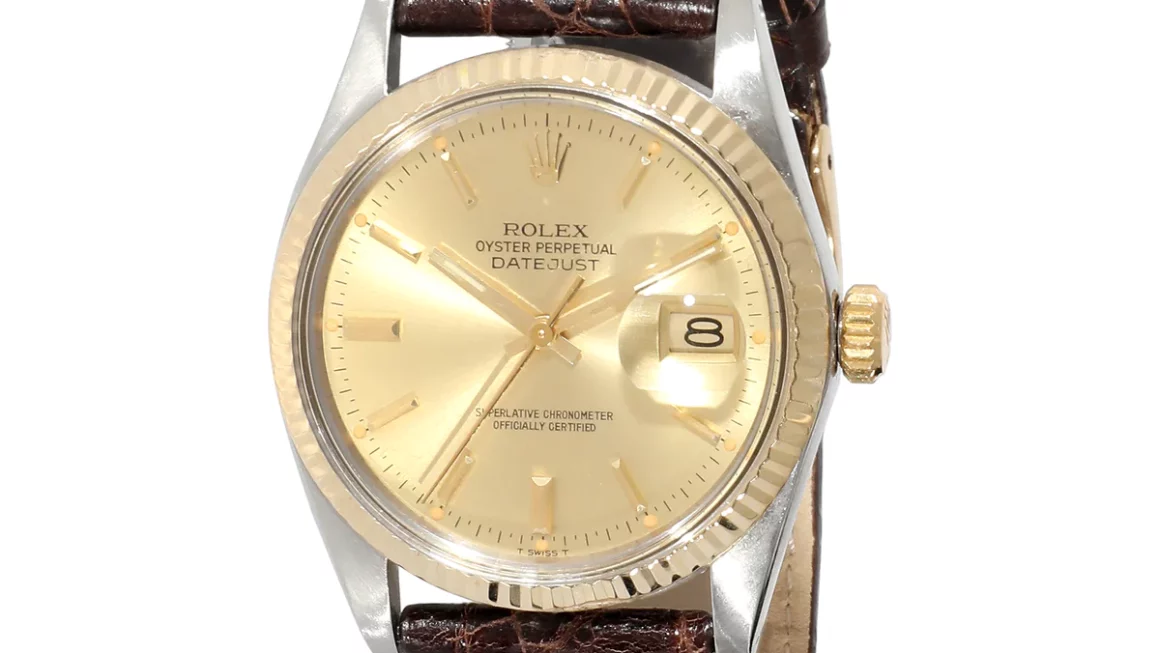

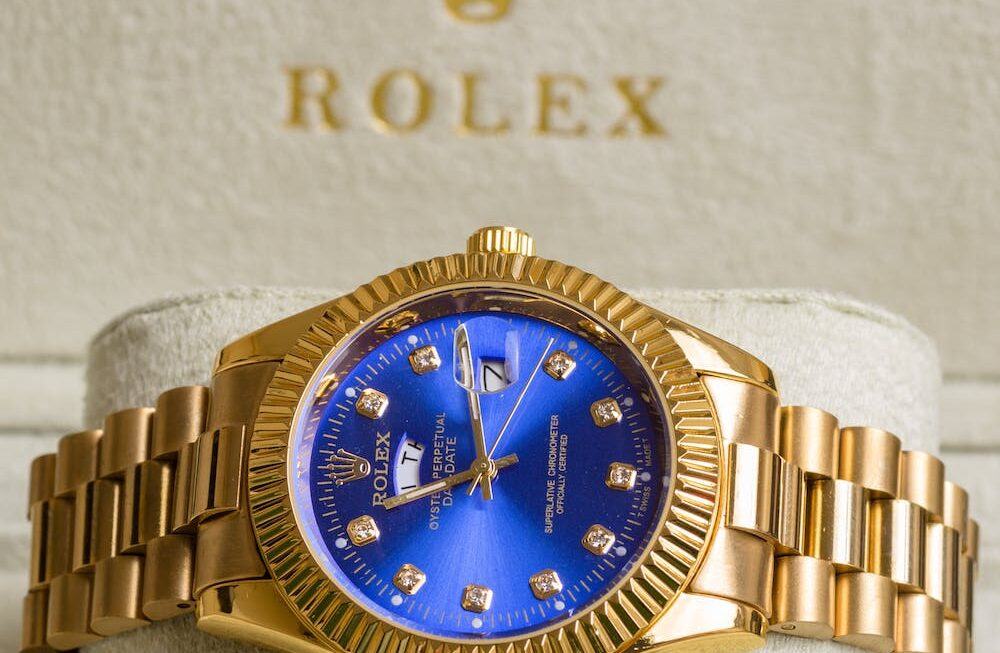

Before diving into the nitty-gritty details of the Bucherer Acquisition by Rolex, it’s crucial to understand the historical context that frames this landmark deal. Rolex, founded in 1905, has been a paragon of Swiss watchmaking known for its precision, durability, and luxury.

On the other hand, Bucherer, established in 1888, has been a cornerstone in the watch retail landscape, boasting an extensive range of high-end brands in its portfolio. Interestingly, the relationship between Rolex and Bucherer isn’t new; it dates back to 1924, making this acquisition a significant milestone in a nearly century-old partnership.

The Anatomy of The Bucherer Acquisition Deal

Now that we’ve set the historical stage, let’s delve into the specifics of this high-profile merger. While the financial details remain under wraps, it’s evident that the move is strategic for both Rolex and Bucherer. Rolex secures a direct pipeline to Bucherer’s extensive retail network, and Bucherer, in turn, gains the backing of Rolex’s unmatched brand power.

Regarding regulatory clearances, the merger faced rigorous scrutiny to ensure compliance with all legal and competitive benchmarks. Given the international stature of both companies, the transaction had to navigate a maze of multi-jurisdictional reviews involving various regulatory agencies across various nations. After exhaustive assessments, the necessary approvals were secured, paving the way for a seamless transition.

Management Transition: Leadership Changes and Continuity

The acquisition isn’t just a merging of assets and brand strengths; it also brings about a change in leadership roles. While Bucherer will continue to operate as a separate entity, it will do so under the strategic guidance of Rolex’s experienced management team.

This raises questions about how the existing leadership at Bucherer will adapt to this new arrangement. Will there be a reshuffling of key positions, or will the current executives continue to steer the ship? What’s certain is that the transition is designed to be as smooth as possible, ensuring that both companies continue to thrive in their respective markets.

Strategic Implications: The Ripple Effect of the Rolex-Bucherer Merger

With the regulatory hurdles cleared and the deal sealed, it’s time to explore the strategic implications of this monumental merger. This isn’t just a business transaction; it’s a seismic shift that has the potential to redefine the contours of the luxury watch landscape.

For Rolex, the acquisition provides an unparalleled opportunity to broaden its retail reach. Bucherer’s strong presence in key markets like Europe and the United States offers Rolex a platform to showcase its timepieces to a wider, yet targeted, audience.

But it’s not just about expansion; it’s also about deepening customer engagement. The acquisition could pave the way for more personalized shopping experiences, perhaps through AI-driven recommendations or exclusive in-store events. Furthermore, we could even see exclusive Rolex collections that are available only at Bucherer outlets, adding a layer of exclusivity and allure to the Rolex brand.

Financial Synergies: The Underlying Economics of the Deal

Moving on from the strategic implications, let’s delve into the financial synergies that make this acquisition a win-win for Rolex and Bucherer. While the exact financial terms remain confidential, industry experts speculate that the deal could offer significant cost savings and revenue synergies.

For Rolex, the acquisition could streamline supply chain operations, reducing costs and increasing efficiency. On the other hand, Bucherer stands to benefit from increased foot traffic and sales, thanks to the Rolex brand’s magnetic pull.

The acquisition also opens up opportunities for cross-promotion and bundled offerings, which could drive up average transaction values for both companies. In a market where customer loyalty is hard to come by, these financial synergies could be the key to long-term profitability and market dominance.

The Statistical Significance of Rolex and Bucherer

When it comes to industry dominance, the numbers speak volumes. Rolex, with an estimated brand value of over $8 billion, produces around one million timepieces annually and enjoys a customer retention rate of over 90%. Bucherer, on the other hand, operates more than 30 stores worldwide and is estimated to have annual revenues exceeding $300 million.

The retailer also boasts a diverse portfolio featuring over 20 luxury watch brands. These impressive statistics underscore the magnitude of the Rolex Bucherer Acquisition, highlighting why this merger is more than just a business transaction—it’s a union of two industry titans with significant market influence.

Global Impact: Shifting The Balance in The Luxury Watch Market

Considering the broader implications of this acquisition, it’s essential to look at its potential global impact. The luxury watch market is a fiercely competitive space, with several brands vying for consumer attention. The Rolex-Bucherer merger could tilt the scales in favor of both companies, giving them a competitive edge that extends beyond their home markets.

For instance, Bucherer’s strong foothold in Europe could serve as a gateway for Rolex to penetrate deeper into markets it has yet to tap into fully. Conversely, Rolex’s global brand recognition could elevate Bucherer’s status in markets where it is less known, such as Asia and the Middle East. This symbiotic relationship could create a ripple effect, influencing consumer preferences and setting new trends in the luxury watch industry worldwide.

Implications For Online Pre-Owned Rolex Dealers

The Bucherer Acquisition also casts a spotlight on the online market for pre-owned Rolex watches. With Bucherer’s extensive retail network now under the Rolex umbrella, the brand could potentially exert greater control over the distribution and resale of its timepieces. This development could pose challenges for online dealers specializing in pre-owned Rolex watches, as they may face increased competition and stricter regulations. However, it could also open up new avenues for collaboration and authentication services, especially if Rolex ventures into the certified pre-owned market through Bucherer’s established platform.

Brand Identity: Preserving Bucherer’s Legacy

One of the most intriguing aspects of this acquisition is how it will affect Bucherer’s established brand identity. Bucherer has a long-standing legacy in the luxury watch retail space and is known for its curated collections and personalized customer service.

The post-acquisition challenge will be to preserve this unique identity while integrating with Rolex’s global brand. Both companies are vested in ensuring that Bucherer’s brand essence remains intact, as it’s one of the key factors contributing to its success. It will be fascinating to see how this balance is struck, ensuring that Bucherer retains its individuality while benefiting from Rolex’s global reach.

Consumer Behavior: The Psychological Impact

The Rolex Bucherer acquisition isn’t just a business move; it’s a shift that could significantly influence consumer behavior and perceptions. For Rolex enthusiasts, the acquisition may offer a sense of assurance, knowing that an even stronger retail network now backs their favorite brand.

On the flip side, Bucherer’s loyal customer base might have concerns about potential changes in the product lineup or service quality. However, the overarching sentiment is likely to be one of excitement and anticipation. The union of these two giants in the luxury watch industry promises consumers more variety, exclusivity, and perhaps even some unique collaborations that could redefine luxury watch ownership.

Market Dynamics: The European Perspective

The acquisition has a particular significance for the European market, where Bucherer has a strong retail presence. This move could potentially shift the balance of power in the European luxury watch sector, giving Rolex an even stronger foothold.

It’s not just about sales; it’s about influence and market saturation. With Bucherer’s extensive European network now under the Rolex umbrella, other luxury watch brands might find it challenging to compete at the same level. This could lead to reevaluating marketing strategies and partnerships for other players in the European market, making the acquisition a game-changer in more ways than one.

The Wake-Up Call for Competing Brands

For competing luxury watch brands, the Rolex Bucherer Acquisition serves as a wake-up call, signaling a seismic shift in the competitive landscape. This merger not only consolidates Rolex’s market position but also extends its retail reach through Bucherer’s established network.

Brands that once considered themselves on par with Rolex or Bucherer will now have to reevaluate their strategies to compete with this newly formed powerhouse. Whether it’s reconsidering retail partnerships, ramping up marketing efforts, or innovating product lines, competitors must up their game to maintain market share and customer loyalty in this altered scenario.

A New Chapter in Luxury Watchmaking

As we wrap up our comprehensive analysis of the Rolex Bucherer Acquisition, it’s evident that this deal is a watershed moment in the luxury watch industry. This acquisition doesn’t merely signify a change in ownership; it marks the beginning of a new era in brand-retailer dynamics, consumer engagement, and global market influence.

From the strategic alignment of two industry titans to the ripple effects that will undoubtedly reshape the competitive landscape, this acquisition is a masterstroke that promises to redefine the game’s rules.

Whether you’re a Rolex aficionado, a Bucherer loyalist, or an industry analyst, one thing is clear: the Rolex Bucherer merger is a pivotal event that will be studied, analyzed, and referenced for years to come.

If you found this deep dive enlightening, we’d love to hear your thoughts. Please feel free to comment below and share this post to keep the conversation going.

Mark.